9 steps for value investing

The first 7 criteria are used to determine if the stock you are investing in is a GREAT BUSINESS that will grow in value over time.

The 8th and 9th criteria are used to determine if the price is right and if it is the BEST TIME to buy the stock.

http://wealthacademyinvestor.com/showarticle.php?showarticleid=61&pid=2&subid=22

Rule of 72

Rule:

“In wanting to know for any percentage, in how many years the capital will be doubled, you bring to mind the rule of 72, which you always divide by the interest, and the result is in how many years it will be doubled. Example: When the interest is 6 percent per year, I say that one divides 72 by 6; obtaining 12, and in 12 years the capital will be doubled.”

In finance, the rule of 72, the rule of 70 and the rule of 69 are methods for estimating an investment's doubling time. The number in the title is divided by the interest percentage per period to obtain the approximate number of periods (usually years) required for doubling. Although scientific calculators and spreadsheet programs have functions to find the accurate doubling time, the rules are useful for mental calculations and when only a basic calculator is available.

Sales

- Sales (also known as revenue ) tell you the dollar amount of goods and services a company sells. This is important because what it really tells you is the amount of money being brought in as a result of the customers' desire for whatever the company is selling. It is also important, however, to know how much it costs to sell the goods and services offered by the company. This cost is called the Cost of Goods Sold.

Reason for improvement in sales

- demand for product or services company provides increases (good observation)

- Company is able to increase price of products/services (good observation)

- company purchase some company or merged with some company (neutral observation).

Reason for decrease in sales

- company might have sold some operation to other company (neutral observation).

- demand for product or services company provides decreases (bad observation)

- growth in sales is more important than level of Sales

- if sales has gone down for one year and underlying problems are one time only and recoverable then it is OK to buy company.

- if sales has gone down for 3-4 years continuously then it is reason for worry, and you don't want to invest in company.

- compare the sales growth in the company you are researching with the growth in the industry.

- In general, sales growth of about 10% is considered good for large-cap companies. For mid-cap and small-cap companies, sales growth of over 20% is ideal.

GDP Components and GDP(%)

From nearly 80% of GDP, private consumption is now around 50% – that means more and more of our economy is dependant on the other factors: Fresh investment, Government Expenditure and Net Exports. The good thing still is that if we encourage private consumption, we will have the highest GDP impact; but our policies lead us to desire saving instead of spending.

Private consumption has been dipping and a larger amount of GDP has been as investments, or “gross capital formation”.

Return On Assets (ROA)

- This has a stronger effect on: 1) The cash flows to the shareholder, and 2) Whether the company has opportunities to grow going forward.

- In growth industry, company having higher ROA is better than other company in same industry. In stagnant industry this may be less useful.

- Investor often see growth in company but fail to consider cost for that growth. All companies require investments in assets in order to support growth, whether it's in the form of fixed assets, working capital, or the acquisition of other firms. The companies with the best return on assets (or return on invested capital) are the ones that reward their investors with cash, not just paper profits.

Peter Lynch's Investing Insights (from One Up On Wall Street)

Peter Lynch insights (from One Up On Wall Street)

- You don’t need to make money on every stock you pick

- Advance/declines numbers paints more realistic picture about market movements.

- You don’t want to be forced to sell in losing market to raise cash. Time is on your side, when you are a long term investor.

- An successful investor once said: “bearish arguments always sounds more intelligent”

- Rule number one is “Stop listening to professionals”.

- Finding promising company is only first step. The next step is doing research. It is research which helps you to sort out good company from bad companies.

-

- Logic is very important in stock picking as it helps you to identify peculiar illogic of Wall Street.

- Will Rogers once said, “Don’t gamble. Take all your savings and buy some good stock and hold it till it goes up, then sell it. If it doesn’t go up, don’t buy it.”

- You can find terrific opportunities in neighborhood or at the workplace, months or even years before news has reached to analyst and fund managers they advice.

- Historically, investing in stocks is more undeniably more profitable than investing bonds.

- Buy the right stocks at wrong price at wrong time and you would suffer great losses.

-

Stocks are most

likely to be accepted as prudent at the moment they are not.

- Once the unsettling fact of risk in money is accepted, we can begin to separate gambling from investing not by type of activity but by skills, dedication and enterprise of the participant.

- To me, the investment is simply a gamble where you managed to tilt the odds in your favor.

- There is a lot of information in open hands, if you know where to look for it.

- By asking some basic questions about companies, you can learn which are likely to grow and prosper, which are unlikely to grow and prosper, and which are entirely mysterious.

- Consistent winners raise their bet as their position strengthens, and they exit the game when the odds are against them,

- Over the time, risks in stock markets can be reduced by proper play just as risk in stud poker is reduced.

- Risks have more to with investors rather than investment.

- You have to be able to make decision without complete or perfect information. Things are almost never clear on Wall Street and when they are it’s too late to take profit from it.

- It’s crucial to be abele to resist your human nature and “gut” feelings.

- It’s that by the time signal is received; the message has already been changed.

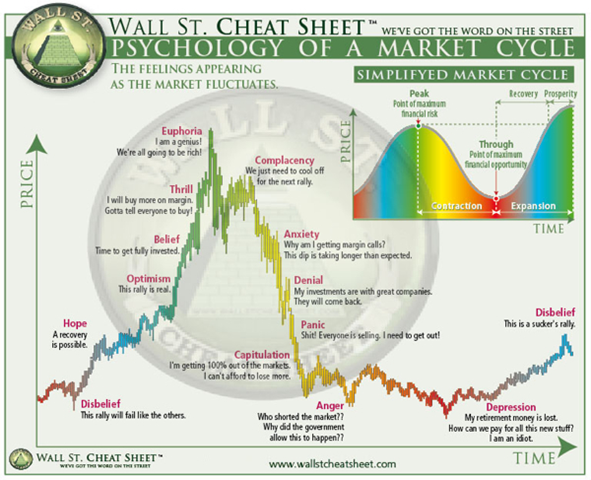

- Things inside human mind make them terrible stock market timers. The unwary investor continuously passes in and out of three emotional states: concern, complacency, and capitulation. He is concerned after the stock market has dropped or economy has seemed to falter, which keeps him from buying good companies at bargain prices. Then when he buys at higher prices, he gets complacent as his stocks are going up. This is precisely the time he ought to be concern enough to check fundamentals, but he isn’t. Then when his stocks fall on hard times and prices fall below to his purchase price he capitulates and sells in a snit.

- The true contrarians investor waits for the things to cool down and buys stocks that nobody pays attention. Especially those that make Wall Street yawn.

- The trick is not to trust your gut feelings but rather to discipline you to ignore them. Stand by your stocks until the fundamental story of the company hasn’t changed.

- Forecasting does not work in stock market.

-

Remember, things

are never clear until it is too late

- Pick the right stocks, and stock market takes care of itself.

- Take advantage of what you already know.

- Look for opportunities that are not in radar of Wall Street.

- Invest in companies, not in stock market.

- Ignore short term fluctuations.

- The person in edge is always in a position to outguess the person with no edge.

- Six general categories:

o Slow growers

o Stalwarts

§ They offer pretty good protection during recessions and hard times. So always keep some stocks from this category.

o Fast growers

§ Small, aggressive enterprise that grow at 20-25% a year.

§ This is land for 10-40 baggers

§ A fast growing company does not necessarily to be in fast growing industry.

§ When an underfinanced company headaches, it usually end up in bankruptcy.

§ As long as they keep it up, fast growers are big winner in stock market. Look for stocks having strong balance sheets and making substantial profits. The trick is to figure out when they will stop growing and how much to pay for the growth.

§

o Cyclical

§ A cyclical is a company whose sales and profits rise and fall in regular if not completely predictable fashion.

§ In cyclical industry, business expands and contracts, then expands and contracts again.

§ Autos, airlines, tire companies, steel companies, chemical companies are all cyclical. Even defense companies fall in this category.

o Asset plays

§ An asset play is any company that’s sitting on something valuable that you know about, but that Wall Street crowd overlooked.

§ The asset play is where local edge can be used to great advantage

§ The asset may be as simple as cash, or in real estate, oil, metals, newspapers, TV stations, radio. etc

o Turnarounds

§ They are depressed, battered, and often can go for bankruptcy.

§

§ The best thing to invest in successful turnaround is that their ups and downs are least related to general market.

§ The occasion major success makes the turnaround business very exciting and very rewarding as well.

§ In this category, you have to be patience, keep with news and read with dispassion.

§ The only possible aspect is that some companies that diworseify themselves into sorry shape are future candidates for

- Smaller fast company risk extinction, while larger fast grower risk a rapid devaluation, when they begin to falter.

- Once a fast grower gets too big, it faces the same dilemma as Gulliver in Lilliput. There is simply no place for it to stretch out.

- turnarounds,

- Look for company which has “any idiot can run this” characteristic.

- 13 attributes of perfect company:

o It sounds dull or ridicules

o It does something dull

o It does something disagreeable

o It’s a spinoff

o The institution don’t own it and analyst don’t follow it

o The negative rumors abound.

o There is something depressing about it

o It’s a no growth industry

o It’s got a niche

o People have to keep buying it’s product or service.

o It’s a user of technology

o The insiders are buying

§ The only one reason that insiders buy: they think stock price is undervalued and will eventually go up.

o The company is buying back shares

§ Buy backs can not help but rewards investors

o

- Avoid hottest stock in hottest industry.

- Avoid diworseifications: the only good thing for investors about this: 1) buy company being acquired 2) finding turnarounds candidate from company which are victims of diworsification.

- If stock prices sways away from earnings line then sooner or late it will come back to earnings line.

- Avoid excessively high p/e ratio stocks. Excessively high P/E ratio is a handicap to stock.

- Try to learn as much as possible about what the company is doing to bring added prosperity, the growth spurt, or whatever happy event is expected to occur.

- Two-minute monologue

o Sample for Asset play:

§ “The stock sells for $8, but the videocassette division alone is worth $4 a share and real estate is worth $7. That’s a bargain in itself.. And I’m getting rest of a company in minus $3. Insiders are buying, and company has steady earnings, and there is not debt also. ”

o Sample for fast growers:

§

“La Quinta is a motel chain that started

out in

o Sample for stalwarts:

§ “Coca-cola is selling at low end of its p/e range. The stock has not gone anywhere in two years. The company has improved itself in several ways. It sold half of its interest in Columbia Pictures to the public. Diet coke has sped up growth rate dramatically. Last year Japanese drank 36% more coke than year before, and Spanish upped their consumption by 26%. That’s phenomenal progress. Foreign sells are excellent in general. Through a separate stock offering, Coca cola has bought many of its independent regional distributers. Now company has better control over distribution and domestic sales. Because of these factors, coca cola may do better than people think.”

o Sample for turn arounds:

§ “General Mills has made great progress in curing its diworsification. It’s gone from eleven basic businesses to two. By selling Eddie, Kenner etc and getting top dollars for these excellent companies, General Mills has returned to doing what it does best: restaurants and packaged foods. The company has been buying back millions of it shares. The seafood subsidiary has grown from 7% to 25% in seafood market. They are coming with great health conscious products. Earnings are up sharply”

o Sample for cyclical company:

§ “There has been a three year business slump in auto industry but this year things have turn around. I know that because car sales are up across board for the first time in recent memory. I notice that GM’s new models are selling well and in last eighteen months the company has closed five inefficient plants, cut twenty percent labor cost, and earnings are about to turn sharply higher.”

o Sample for slow grower company:

§ “This company has increased earnings every year for last ten years, it offers and attractive yield, it’s never reduced or suspended dividend, and in fact it raised the dividend yield in good times and bad times, including last three recessions. Its telephone utility and the new cellular operations may add a substantial kicker to the growth.”

- When looking at same sky, people in mature industry see clouds and people in immature industry see pie.

- When cash is improving relative to its debt. It’s improving balance sheet. When cash exceeds debt its very favorable.

- In general, a p/e ration that’s half the growth rate is very positive and double the growth rate is very negative.

- A normal corporate balance sheet has 75% equity and 25% debt.

- Among turnarounds and Trouble Company always pay more attention to debt. More than anything else its debt that determines which company will survive and which company will bankrupt in a crisis. Young companies with heavy debts are always at risk.

- A company with a 10-20 years record of dividend paying is best bet for dividend companies.

- Cyclical are not always reliable dividend payers.

- In manufacturing or retail, check inventories. If they are piling up then it’s bad. If inventories grow faster than sales, it’s red flag.

- Business that can get away by rising prices year over year without losing customers is a terrific investment.

- Pretax profit margin is a good tool to compare companies in same industry. While it is not useful for across industry.

- While in hard times companies with high profit margins fights well, when business rebounds, companies with low pretax profit margin are highest beneficiary. This is why business in depressed enterprise on the edge of disaster becomes very big winners on rebound. It happens again and again in auto, steel, cement, chemical, paper, airline, electronics, and nonferrous metals.

- You want relatively high profit margin stock which you want to hold in good times and bad times. And low profit margin stock in a successful turnaround situation.

- Checklist

o General checklist:

§ The p/e ration is high or low for this specific company and for similar companies in industry.

§ % of intuitional ownership, the lower the better.

§ If insider buying great. Company buy great. Both are positive sign.

§ Record of earning growth and whether earnings are consistent or sporadic. (in Asset play, this check does not matter much)

§ Whether the company has a strong balance sheet or a week balance sheet (debt-to-equity ratio) and how its rated for financial strength.

§ The cash position.

o Slow growers:

§ You buy this for dividend purpose, so see if dividend always been paid. And whether they are routinely raised.

§ Find out what % earnings is being paid out dividend.

o Stalwarts:

§ These are big company which is not likely to go out of business. You might not get this company at dirt cheap price but try buy at moderate p/e. market throws opportunity to buy such company from time to time.

§ Check for possible diworsification that may reduce earnings in future.

§ Check for company’s long term growth and whether it kept momentum or not.

§ If you want to hold for very long time than check how the company fared in last couple of recessions and hard times.

o Cyclical

§ Keep a close watch on inventories, demand-supply relationships. Watch for new entrants in market, which is dangerous development.

§ Anticipate shrinking p/e as business recovers and investors look ahead to end of cycle, when peak earning are achieved.

§ If you know cyclical, you have advantage in identifying cycles.

o Fast growers:

§ Investigate product which suppose to enrich company is major part of its business.

§ Check growth rate in recent times.

§ Company has duplicated its success in other city or town, to prove that expansion works.

§ Does Company still have room to grow?

§ P/E ration should be near to growth rate and never more.

§ Whether expansion is speeding up or slowing down.

§ Few institutions hold the stock and few analyst cover it.

o Turnarounds

§ Look at debt structure

§ If already bankrupt what’s left for share holders?

§ How companies can turnaround?

§ Is business coming back?

§ Are cost being cut?

o Asset play:

§ What’s the value of assets?

§ Is company taking new debt, making assets less valuable?

§ Is there a raider in wings to help shareholders reap the benefits for the assets?

- Put your stocks in category, so you know what to expect from them.

- Big companies have small moves and small companies have big moves

- Consider sixe of company if you want to profit from a specific product.

- Look for companies which are already profitable and have proven that their concept can be replicated.

- Be suspicious of companies with growth rate 50 to 1oo %

- Distrust diversification which can turn out as diworsificaion.

- Invest in simple companies that appear dull, mundane, boring, out of favor and haven’t caught Wall Street’s attention.

- When investing in depressed stocks in trouble companies look for financial strength of companies and avoid with loads of bank debt.

- Company that have no dent, can not go bankrupt

- Base your purchase on company‘s prospect not on management’s resume or speaking ability.

- A lot of money can be made when Trouble Company turns around.

- Being all equal, invest in company where management have significant stake.

- When in doubt. Tune in later.

Portfolio

construction insights

- Invest in 5-15 company is advisable. It is moderate diversification.

- The more stocks you own the more flexibility you have to rotate fund between them.

- Make value integral part of portfolio.

- You portfolio design changes with your age. Young people can have aggressive portfolio while for old people defensive portfolio is advisable.

- Let the winners run, and get rid of losers from portfolio. Distinct winner and loser from fundamental perspective and not based on stock price movement.

- Rotate in and out of stock based what happened to its price as it related to story.

- Have a list of good companies, and buy during free falls, hiccups, collapse, drops etc

- When to sell a slow growers:

o When fundaments are deteriorated then sell even in loss. Generally 30-50% appreciation is good profit in this category.

o No new products are being developed.

o Company has lost its market share for two years.

o New acquisition looks like diworsification

o Company paid so much for its acquisition that balance sheet deteriorate from no debt and million into cash to milling into debt and no cash.

o Even at lower stock price, dividend yield is not high enough to attract investor’s attraction.

- When to sell stalwarts

o When stock price goes above earnings line. Replace it with other stalwarts in same category.

Saving Schemes: National savings certificate

NSC is an assured return scheme and provides for tax rebates under section 88. Interest is payable at 8 per cent for a duration of six years, which is relatively lower compared to other small saving schemes. Here, investors are required to make a single deposit and the interest compounded is returned along with the principal amount on maturity.

However, NSC suffers on account of liquidity, as premature withdrawals can be done under specific circumstances only, such as death of the holder(s), forfeiture by the pledgee or under court's order. Like PPF, NSCs are not suitable for those who yearn for regular income and are basically for those looking at safe long-term investments.

NSC investors enjoy tax benefits under section 88. Interest is eligible for deduction under section 80L upto a maximum limit of Rs 12,000. Also, the accrued interest is automatically reinvested, and qualifies for benefit under section 88.

Thus, NSC is an ideal vehicle for those investors who are looking at tax benefits on a longer-term basis and are not too bothered about liquidity.

Saving Schemes: Kisan Vikas Patra

Want to double your investments in less than nine years? KVP is for you then. But there's a catch. The scheme, which offers to double your money in eight years and seven months, offers no benefits under the Income Tax Act. In terms of liquidity the scheme is better than PPF and NSC.

One can exit the scheme any time after 2.5 years from the investment date, though investors will have to bear the loss of interest for the invested time period. Though KVP is not meant for regular income, it is a safe avenue of investment for those without pressing tax concerns. Liquidity is also reasonably higher here.

Investing: Do's and Don'ts

http://www.businessweek.com/investor/content/dec2008/pi20081217_317510.htm?chan=rss_topStories_ssi_5

Saving Schemes: RBI Relief Bonds

Some bonds have a special provision that allows the investor to save on tax. These are termed as Tax-Saving Bonds, and are widely used by individual investors as a tax-saving tool.

Examples of such bonds are:

- Infrastructure Bonds under Section 88 of the Income Tax Act, 1961

- Capital Gains Bonds under Section 54EC of the Income Tax Act, 1961

- RBI Tax Relief Bonds

For more information visit This Site

1) Debt Snowball (Lowest Balance First): This method is the official debt snowball strategy. The benefit of this method is the psychological effect of seeing the number of debts disappear quickly. According to Dave Ramsey, it's important to build momentum and see success early on. After all, if it was easy to pay off debt, you probably wouldn't need this calculator. :)

2) Highest Interest First: This strategy results in the lowest total interest, but depending on the balance of your higher interest loans, it may take you longer to see your first loan/debt completely paid off. If the difference in the total interest is not significant, than you may get more satisfaction and success from the Lowest Balance First method.

3) No Snowball: Select this option if you want to see how long it will take to pay off the debts based solely on the individual payments you specify (i.e. no snowball effect). In some cases, you may find it will take more than 30 years to pay off some debts.

4) User-Specified Order: There are three options for choosing the order that you want to pay your debts. You can choose "Order Entered in Table", which is self-explanatory. You can also use the Custom column to enter your own formulas or your own ranking and choose "Custom-Highest First" or "Custom-Lowest First". I'd suggest ranking each row using values "10, 20, 30, 40, etc." . The reason to enter the order by 10's or 100's is so that you can easily switch the order. For example, you can move the one marked "30" ahead of "20" by changing the 30 to 19. You can also use the built-in SORT command via the Data menu.

Variation on the Debt Snowball Strategy If you choose the "Lowest Balance First" method, and two of your balances are roughly the same amount, but have very different rates, you might want to switch the order that you pay them off so that you pay the higher rate first. It might not make much difference in how long it takes to pay them off, but it could make a difference in how much interest you end up paying.

Saving Schemes: tax-saving deposite schemes

Yes, this is great step by government for people who want to invest in fixed deposit and looking for tax-saving too on it. Govt of India has understood that education is key to India's future growth. So they want to promote students and parents to aspire for higher educations and to help them Govt will provide low interest rate loans to them. Over all Govt is doing lot of reforms in education sector and for this reforms they need funding, for this funding they have designed special purpose tax-saving deposit schemes. This is good option for people who want to stick to fixed deposits and also want to save tax on it.

For more information read http://economictimes.indiatimes.com/news/economy/finance/Tax-saving-deposit-scheme-to-fund-loans-to-students-educational-institutions/articleshow/5924147.cms

Saving Schemes: Post Office Monthly Income Scheme

For the retired people, the Post Office Monthly Income Scheme is a good savings instrument. The interest is 8% divided on a monthly payout basis. The payout if not required can be channeled to a recurring deposit. The effective returns increases by almost 10% by doing this.

On completion of six years, a 10 per cent bonus on the principal sum is provided. The scheme offers better liquidity, with investors having an exit option after one year from the investment date.

The interest can be credited to a savings account of any bank too. The account can be closed after 1 year with a 5% penalty and after 3 years without any penalty. The limitation however is that the maximum investment for any individual is only Rs.6 L.

The interest on investments as well as bonus received on maturity is eligible for tax benefits under Section 80L.

Saving Schemes: Post Office Recurring Deposit

This is a 5 year scheme where one invests on a monthly basis. However, there does exist an option for the fund to be closed after 3 years, which comes with a penalty of 1%. The advantage with the postal recurring deposit over the bank recurring deposit is that the minimum monthly investment is only Rs.10/- with no upper limit. In case the payment is made once is 6 months or on a yearly basis, there are discounts for that too.

The limitation is that the interest rate is fixed at 7.5% only and auto-debit to bank account is not available.

There are no tax benefits from the scheme. However Post Offices have not been deducting TDS.

Saving Schemes: Mutual Fund Monthly Income Plan – Growth Option

For people who have a higher risk quotient during the short term, monthly income plan (MIP) of mutual funds is good. Here a small portion (generally not more than 20%) of the funds is invested in equity. So the returns can be better than the normal debt mutual fund when the market is rising. The typical returns in the last 3 years are 12% to 14% for the top 5 funds.

However caution needs to be taken when choosing the growth option. This is due to the fact that if we start to receive the monthly payouts there may be months when the principal is used for the payout. This will drain the fund particularly when the market goes down.

Being largely a debt oriented mutual fund, the tax treatment is the same as the debt mutual fund.

Saving Schemes: Company deposites

Companies that offer deposit schemes to consumers tend to offer rates that are in-between bank deposit rates and bank lending rates. This is a win-win situation for the company and the person saving.

The bank has to make a profit when borrowing from the public and lending to companies. So they have an interest rate difference (spread) of about 4.5%. In effect, the deposit holders are paid less and the borrowers are charged more. When a company has direct access to the depositor, both benefit. The depositor gets a better rate than what the bank can offer and the company is able to borrow at a lesser rate when compared to a bank interest rate.

However, it is in the best interest of the borrower to do his reasearch thoroughly and double check how good the credit rating of the company is before investing. On an average estimates show that one can easily get 11% - 12% on reputed companies’ deposits for a 3 year term.

The returns will be taxed as interest and will have TDS.

Saving Schemes: Debt Mutual Funds

Debt Mutual Funds

These are managed funds that invest in debt and debt oriented schemes.

There are a number of advantages that these mutual funds give compared to a direct deposit. The most apparent is the fact that this is a managed fund and the returns can be better as the manager has access to more information and will leverage that compared to individual investors. There is no TDS or tax on the interest. The returns will be processed as capital gains.

Returns from this fund are expected to be good. The top five debt mutual funds have given compounded returns in the range of 10.50-14.50% in the last 3 years. This is much better than the normal bank deposit or company deposit. The advantage is that debt mutual funds can create capital gains when the interest rates go down.

Saving Schemes: Top 5 saving options

In India and everywhere in world, interest rates are rising. well this is good news for some (those who look at making deposits) and bad news for some (those who are looking at taking loans). Now if you fall into first group and are planning to save money, the first thing come to mind is bank FDs. But savings however have to be channeled carefully so that the maximum can be gained from the deposits. Here are the top 5 savings instruments in a rising interest rate regime and better than bank FDs from return perspetive. the top 5 savings instruments are:

1) Debt Mutual Funds

2) Mutual Fund Monthly Income Plan – Growth Option

3) Company Deposits

4) Post Office Recurring Deposit

5) Post Office Monthly Income Scheme

well so you want to save some money then above are good options to channelise your money properly. You should re-adjsut your saving according to current interest rate environmnet.

"when interest rate are rising you should save more in top 3 and when interest rate are going down you should save in bottom 2."

Save Income Tax : additional tax saving Infra BONDS are back

The new deduction comes under section 80CCF.

Robert Kiyosaki on why Rich are getting richer

[source: http://finance.yahoo.com/expert/article/richricher/10316?p=1]

Years ago, when I was just starting my real estate investing career, I considered a condominium in Waikiki as an investment.

The problem was that the investment would have cost me about $300 a month.

A Meaningful Exchange

Back then, a $300-a-month loss would've been the same for me as $300,000-a-month loss would be today. When I ran the numbers past my rich dad, he asked, "Why do you want to lose $300 a month?" In other words, my rich dad wanted to know why I wanted to pay money to invest.

"Well," I told him, "the real estate agent said the condo would go up in value and I would make a profit."

Rich dad chuckled and asked, "How many condos can you afford that cost you $300 a month?"

"But it will probably go up in value, and then I can get my money back when I sell it."

"You're probably right," said rich dad, "but you didn't answer my question. How many investments can you afford that cost you $300 a month?"

At the time, my net after-tax income was only about $2,000 a month, and my expenses were about $1,800 a month, so the reality was that I couldn't afford even one condo that cost me $300 a month -- even if it went up in price sometime in the future.

So my answer was a sheepish, "I can't afford even one that loses me money."

With a smile on his face, rich dad said, "Remember what I've been teaching you. Any fool can lose money on an investment. That doesn't take much financial intelligence."

Investing for a Bleak Future

This advice may sound simple, but if you think about it, millions of investors invest their hard-earned money every day and receive little to nothing in return. In other words, their investment costs them money rather than makes them money.

For example, millions of workers put their money in 401(k) plans, hoping that someday in the future there will be enough in the account for them to retire on. And millions of people put a little money aside, either in a bank or under the mattress, and receive little to nothing in return. They all pay to invest rather than getting paid to invest.

The lesson my rich dad was drumming into my head, and I mean to drum into yours, is that investing should make me richer every month, not poorer. It should put money in my pocket every month, not take money out. To him, it was a miracle that so many financial services salespeople could convince financially naive people that it was smart to pay money to invest.

He wanted people to learn to look harder for better investments -- to be professional investors rather than naive investors. When he asked me, "How many investments can you afford that cost you $300 a month?" he was also asking, "How many investments can you afford that earn you $300 a month?" The obvious answer is, "As many as I can find."

Learn to Earn

If this idea challenges you, don't fret. As I said, my rich dad had to drum this idea into my head.

You have no idea how many times I came to him with great investments that cost me money rather than made me money. And even though he's passed on, I can still hear him reminding me, with every deal I look at, that it should earn, not cost, money.

The good news is that once you understand this lesson and start finding investments that make money, your life is never the same. In my opinion, grasping this distinction is one of the biggest differences between the rich and everybody else.

Not getting this lesson sets people up to fall victim to sales pitches from financial services salespeople, who sell them on the idea that it's smart to "invest for tomorrow" or "put a little bit away today for a brighter future."

If you've read my books, you already know that I invest primarily for cash flow, not capital gains. Most people invest for capital gains, which is why they buy a stock, mutual fund, or piece of real estate and hope the price will go up. Not me. While I occasionally invest for capital gains, I prefer to invest for cash flow.

Now, I can hear some of you complaining that it is harder to find investments for cash flow, and that's true. That's why most investors invest for capital gains. It's also why most salespeople sell naive investors on the promise of riches tomorrow rather than riches today.

Separating the Pros from the Know-Nothings

I realize that some of you may be asking, "But how do I find investments that make me money today?" I know from personal experience how frustrating this question can be.

All I can do is encourage you to keep asking yourself that question. That's what I did and continue to do today. I'll repeat myself yet again: Knowing the difference between investments that cost you money and ones that make you money is what separates rich investors from naive investors.

This even applies to business. I'm always amazed at how many people assume a business has to lose money before it makes money.

Recently, I had to let go a whole team of managers from one of my businesses because all they did was lose money. When I pressured them as to why the business was failing, many in the group reiterated this cracked philosophy. As I said, I had to let them go and replace them with people who knew how to make money.

Nothing Worthwhile Is Easy

I often use my wife Kim as an example of my rich dad's lesson. Her first investment made her a net $25 a month. It was a two-bedroom, one-bath house. To consistently see moneymaking investments required time, study, discipline, and effort on her part.

Yet once she learned to spot an investment that made money, she was part of a world very few people ever see. Today, she makes tens of thousands of dollars a month from her investments.

I'm not saying it's simple to find investments that make money right away. As the saying goes, "If it was easy, everyone would do it." Yet we all know how easy it is to find investments that lose money or that cost money -- that's why there are so many people who invest for tomorrow rather than for today.

My rich dad would advise you to keep looking, and train yourself to invest like a pro.

+relation.jpg)