“I’ve never found anyone who’s said no or hung up the phone when I called-I just asked. And when people ask me, I try to be as responsive, to pay that debt of gratitude back. Most people never pick up the phone and call, most people never ask. And that’s what separates, sometimes, the people that do things from the people that just dream about them. You gotta act. And you’ve gotta be willing to fail, you gotta be ready to crash and burn, with people on the phone, with starting a company, with whatever. If you’re afraid of failing, you won’t get very far.” - Steve Jobs

Charlie Munger on The failure of General Motors

General Motors, out of the profits of their good years, they could have bought, every year, for many years, a big company. They could have bought Eli Lilly one year and Merck the next, and United Technologies. General Motors could own the world. Instead, what they declared to their shareholders was a goose egg. They took the common equity to zero. And they would say it was all somebody else’s fault. The climate was bad, the unions got powerful. Those damn Asians and Europeans were too competitive.

The truth of the matter is, their very prosperity made them weak. The dealerships got in the hands of inheritors, and the executives on the sales field go around and drink martinis with inheritors, and didn’t pay enough attention to defects in their vehicles. And one thing led to another, and when they were all done the shareholders’ equity went to zero.

And that was in a company that at its peak was one of the most admirable companies in the world. Take the stuff that Boss Kettering (Charles Kettering – head of research at General Motors from 1920 to 1947) had invented in the early days. Kettering was one of the most useful citizens that ever lived in America.

A self starter on a car is a wonderful thing. Under the old system, you frequently broke your arm. You would give it a crank and it would answer back by spinning backwards and breaking your arm. I would much rather push a button than have my arm broken. Nor do I have the opportunity to go and crank in the sleet and snow.

Charlie Munger on Making Bad Decisions

You know what Rudyard Kipling said? Treat those two imposters just the same success and failure. Of course, there’s going to be some failure in making the correct decisions. Nobody bats a thousand. I think it’s important to review your past stupidities so you are less likely to repeat them, but I’m not gnashing my teeth over it or suffering or enduring it. I regard it as perfectly normal to fail and make bad decisions. I think the tragedy in life is to be so timid that you don’t play hard enough so you have some reverses.

Charlie Munger on thinking everyone will be successful with investments

I think the idea that everybody is going to have wonderful results from investing is inherently crazy. Nobody thinks everybody is going to have wonderful results from playing poker.

In the end, the wealth of the country is based on the productivity of the country, which only advances so fast. Of course, if you pay more and more people for not working, it’s hard to see how that grows the productivity of the country.

In the end, the wealth of the country is based on the productivity of the country, which only advances so fast. Of course, if you pay more and more people for not working, it’s hard to see how that grows the productivity of the country.

Charlie Munger on Incentives of managers in tough businesses

I should tell you people a story, because you are groupies for stories. I talked recently to a man who shall go nameless. But his company was one of the great growth stocks of America.

And they had armies of PhD’s in there who had mastered very difficult disciplines. And they had patents, and technology, and know how, what have you and hard to replace plants. What they make is difficult to make in a lot of different categories.

And the profits in the business are very mediocre, to put it mildly. And it isn’t that it has been that badly run. It’s just that everybody’s learned how to make these difficult things, and there are too many of them trying to make them. It just gets terrible. And what happens then is, you’re now the CEO of the place and you see it’s getting tough. You view yourself as a guy that knows how to fix things. You never have a category in your mind of, “It’s too tough to fix,” which is a really stupid idea. You can recognize all kinds of things that are too tough to fix.

But if you don’t, then you are a sucker for some narrative to say, maybe there’s some company in your industry that makes something really complicated that other people can’t match. And you say, “Well, I’ll buy that. That solves my problem.” But your friendly investment banker and your friendly management consultant want you to buy it at 30 times’ earnings and 12 times’ book. Of course, at that price, it won’t solve your problems. And you do it anyway. After all, you’ve got consultants, and it gives you hope.

And they had armies of PhD’s in there who had mastered very difficult disciplines. And they had patents, and technology, and know how, what have you and hard to replace plants. What they make is difficult to make in a lot of different categories.

And the profits in the business are very mediocre, to put it mildly. And it isn’t that it has been that badly run. It’s just that everybody’s learned how to make these difficult things, and there are too many of them trying to make them. It just gets terrible. And what happens then is, you’re now the CEO of the place and you see it’s getting tough. You view yourself as a guy that knows how to fix things. You never have a category in your mind of, “It’s too tough to fix,” which is a really stupid idea. You can recognize all kinds of things that are too tough to fix.

But if you don’t, then you are a sucker for some narrative to say, maybe there’s some company in your industry that makes something really complicated that other people can’t match. And you say, “Well, I’ll buy that. That solves my problem.” But your friendly investment banker and your friendly management consultant want you to buy it at 30 times’ earnings and 12 times’ book. Of course, at that price, it won’t solve your problems. And you do it anyway. After all, you’ve got consultants, and it gives you hope.

Quote on Budgeting

"Annual income twenty pounds, annual expenditure nineteen pounds nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pound ought and six, result misery" - Charles Dickens

Charlie Munger on Resentment

“Resentment has always worked for me exactly as it worked for Carson. I cannot recommend it highly enough to you if you desire misery. Johnson spoke well when he said that life is hard enough to swallow without squeezing in the bitter rind of resentment.

For those of you who want misery, I also recommend refraining from practice of the Disraeli compromise, designed for people who find it impossible to quit resentment cold turkey. Disraeli, as he rose to become one of the greatest Prime Ministers, learned to give up vengeance as a motivation for action, but he did retain some outlet for resentment by putting the names of people who wronged him on pieces of paper in a drawer. Then, from time to time, he reviewed these names and took pleasure in noting the way the world had taken his enemies down without his assistance.” - Charlie Munger

Source: http://www.thecrosshairstrader.com/2014/08/charles-t-munger-and-the-prescription-for-a-life-of-misery/

Charlie Munger on Resentment

Charlie Munger on Resentment:

“Another thing, of course, is that life will have terrible blows in it, horrible blows, unfair blows. It doesn’t matter. And some people recover and others don’t. And there I think the attitude of Epictetus is the best. He thought that every missed chance in life was an opportunity to behave well, every missed chance in life was an opportunity to learn something, and that your duty was not to be submerged in self-pity, but to utilize the terrible blow in constructive fashion. That is a very good idea.”

“Generally speaking, envy, resentment, revenge and self-pity are disastrous modes of thoughts. Self-pity gets fairly close to paranoia, and paranoia is one of the very hardest things to reverse. You do not want to drift into self-pity. It’s a ridiculous way to behave and when you avoid it, you get a great advantage over everybody else or almost everybody else because self-pity is a standard condition, and yet you can train yourself out of it.”

Source: https://www.youtube.com/watch?v=NkLHxMWAZgQ

Charlie Munger on Passion

“I have never succeeded very much in anything in which I was not very interested. If you can’t find something, I don’t think you’ll succeed very much, even if you’re fairly smart. I think that having this deep interest in something is part of the game. If your only interest is Chinese calligraphy I think that’s what you’re going to have to do. I don’t see how you can succeed in astrophysics if you’re only interested in calligraphy.” - Charlie Munger

“You’ve got to find what you love. And that is as true for your work as it is for your lovers. Your work is going to fill a large part of your life, and the only way to be truly satisfied is to do what you believe is great work. And the only way to do great work is to love what you do. If you haven’t found it yet, keep looking. Don’t settle. As with all matters of the heart, you’ll know when you find it. And, like any great relationship, it just gets better and better as the years roll on. So keep looking until you find it. Don’t settle.” - Steve Jobs

Many people are attracted to investing because of wrong reasons like expensive cars etc. If we look at successful people long-term investors, we will find that they are driven by intellectual challenge that investing possess with wealth being an effect of that process and not other way around.

Passion fulfills our lives and not money or recognition.

Passion fulfills our lives and not money or recognition.

Why you should not dip into your retirement corpus to fund your child's higher education

http://articles.economictimes.indiatimes.com/2015-01-19/news/58231347_1_rs-20-lakh-ppf-retirement

Explanation of Warren Buffet's two rules of investing

http://www.livemint.com/Money/DIyXPTM5KdaagdXJqkTbQJ/Why-downside-matters-and-some-basic-arithmetic.html

Baseball - The Best Sports Analogy to Investing

Baseball - The Best Sports Analogy to Investing

- Know your sweet spot, and only swing at pitches you can hit. - Ted Williams (in book The Science of Hitting)

- The biggest difference between baseball and investing is in investing there are no called stikes.

- “The stock market is a no-called-strike game. You don’t have to swing at every everything- you can wait four your pitch. The problem when you are a money manager is that your fans keep yelling, ‘Swing, you bum!’ ” - Warren Buffett

Charlie Munger on How you can get into great business

“We’ve really made the money out of high quality businesses. In some cases, we bought the whole business. And in some cases, we just bought a big block of stock. But when you analyze what happened, the big money’s been made in the high quality businesses. And most of the other people who’ve made a lot of money have done so in high quality businesses.Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6% return—even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with a fine result.So the trick is getting into better businesses. And that involves all of these advantages of scale that you could consider momentum effects.How do you get into these great companies? One method is what I’d call the method of finding them small get ‘em when they’re little. For example, buy Wal-Mart when Sam Walton first goes public and so forth. And a lot of people try to do just that. And it’s a very beguiling idea. If I were a young man, I might actually go into it.” – Charlie Munger (in his speech “A Lesson on Elementary, Worldly Wisdom As It Relates to Investment Management & Business.” given in 1995)

“How do you get into these great companies? One method is what I’d call the method of finding them small get ‘em when they’re little. For example, buy Wal-Mart when Sam Walton first goes public and so forth. And a lot of people try to do just that. And it’s a very beguiling idea. If I were a young man, I might actually go into it.

But it doesn’t work for Berkshire Hathaway anymore because we’ve got too much money. We can’t find anything that fits our size parameter that way. Besides, we’re set in our ways. But I regard finding them small as a perfectly intelligent approach for somebody to try with discipline. It’s just not something that I’ve done.

Finding ‘em big obviously is very hard because of the competition. So far, Berkshire’s managed to do it. But can we continue to do it? What’s the next Coca-Cola investment for us? Well, the answer to that is I don’t know. I think it gets harder for us all the time….

And ideally and we’ve done a lot of this—you get into a great business which also has a great manager because management matters. For example, it’s made a great difference to General Electric Company (NYSE:GE) that Jack Welch came in instead of the guy who took over Westinghouse—a very great difference. So management matters, too.

Occasionally, you’ll find a human being who’s so talented that he can do things that ordinary skilled mortals can’t. I would argue that Simon Marks—who was second generation in Marks & Spencer of England—was such a man. Patterson was such a man at National Cash Register. And Sam Walton was such a man.

These people do come along—and in many cases, they’re not all that hard to identify. If they’ve got a reasonable hand—with the fanaticism and intelligence and so on that these people generally bring to the party—then management can matter much.

However, averaged out, betting on the quality of a business is better than betting on the quality of management. In other words, if you have to choose one, bet on the business momentum, not the brilliance of the manager.

But, very rarely, you find a manager who’s so good that you’re wise to follow him into what looks like a mediocre business.” — Charlie Munger’s speech, “A Lesson on Elementary, Worldly Wisdom As It Relates To Investment Management & Business”. - Charlie Munger

"There are two kinds of businesses: The first earns 12%, and you can take it out at the end of the year. The second earns 12%, but all the excess cash must be reinvested — there’s never any cash. It reminds me of the guy who looks at all of his equipment and says, “There’s all of my profit.” We hate that kind of business.” - Charlie Munger

Charlie Munger looks for following intangible qualities in companies: strength of management, durability of its brand,

how hard it is to replicate/copy for competitors. Munger likes to invest in companies which does not require continual investment and spat out more cash than it consumed.

Warren Buffett on Great Business

“The ideal business is one that generates very high returns on capital and can invest that capital back into the business at equally high rates. Imagine a $100 million business that earns 20% in one year, reinvests the $20 million profit and in the next year earns 20% of $120 million and so forth. But there are very very few businesses like this. Coke has high returns on capital, but incremental capital doesn’t earn anything like its current returns. We love businesses that can earn high rates on even more capital than it earns. Most of our businesses generate lots of money, but can’t generate high returns on incremental capital — for example, See’s and Buffalo News. We look for them [areas to wisely reinvest capital], but they don’t exist.

So, what we do is take money and move it around into other businesses. The newspaper business earned great returns but not on incremental capital. But the people in the industry only knew how to reinvest it [so they squandered a lot of capital]. But our structure allows us to take excess capital and invest it elsewhere, wherever it makes the most sense. It’s an enormous advantage.” – Warren Buffett (at 2003 Berkshire Hathway meeting.)

“Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6% return—even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with a fine result."- Charlie Munger

Weight of energy in national CPI baskets

Why India is benefiting from lower global oil prices?

Energy occupies a large share of its CPI basket

@bibekdebroy pic.twitter.com/Sd1AflOnXW

— Uday Tharar (@udaytharar) March 17, 2015

Berkshire Hathway's ACQUISITION CRITERIA

Source: http://www.berkshirehathaway.com/2000ar/acq.html

ACQUISITION CRITERIA

We are eager to hear from principals or their representatives about businesses that meet all of the following criteria:

- Large purchases (at least $50 million of before-tax earnings),

- Demonstrated consistent earning power (future projections are of no interest to us, nor are "turnaround" situations),

- Businesses earning good returns on equity while employing little or no debt,

- Management in place (we can't supply it),

- Simple businesses (if there's lots of technology, we won't understand it),

- An offering price (we don't want to waste our time or that of the seller by talking, even preliminarily, about a transaction when price is unknown).

Criteria 2,3,5 &5 can be used by retain investors when choosing their investments into secondary markets

Middle managers acts a router will not longer require in IT industry

http://boomlive.in/middle-managers-act-routers-future-wipro-ceo-kurien/

Ethiraj: Are you also being self critical of your middle management?

Kurien: I think that’s true. It’s not middle management by itself and I wouldn’t define middle management very clearly. There’s middle management that really adds to technology and I think that’s fabulous to have. We absolutely need those guys. And those are people we really treasure.

There are other people who just manage people and that’s the game that you don’t want in the future. Because, having a person who sits as a router, routing traffic from one end to the other, communicating upward and managing downwards is not a function that you require long term. That particular skill set is not going to be required any more.

source: http://alphaideas.in/2015/02/16/alice-wonderland-valuations-indian-equities/

Overvalued stocks due to Fund managers are bullish and want to maintain NAV/AUM.

Consumer stocks: HUL, Colgate, Dabur, Nestle, Marico

Pharma stocks: >30 PE

MNCs: Blue Dart>110, Kenamental>90, GSK>60, Bosch >60x

Scarce/ Unique ideas: Just Dial > 80, Info Edge > 80, Jubililant Foodwork>70, Page > 70, Eicher > 60

The P/E (trailing twelve months) of Colgate has gone up from 34x in April 2014 to currently 48x. Similarly, Nestle from 42x to 53x, HUL from 33x to 44x, Dabur from 36x to 43x, Marico from 28x to 38x, etc. This is despite sales growth being slowest in the last many quarters for some of these companies (in some cases, up to eight quarters!). Similarly the P/E of some pharma companies have gone from mid-20x in April 2014 to mid-30x currently. The two other sectors which are captured by these institutions (partly overlapping with the two mentioned above) are MNCs and scarce/unique ideas. So, any MNC with a 75% parent holding is supposed to be a delisting candidate that justifies a ‘mu-maangi kimat’ for the tenderer (Blue Dart > 115x, 3M 90x, Kennametal 90x, Glaxo Pharma 60x, Bosch 60x). Scarce concepts in the listed space also command mind-boggling valuations (Just Dial 80x, Info Edge 80x, Jubilant Foodworks 75x, Page Industries 70x, Eicher Motors 60x etc.).

Overvalued stocks due to Fund managers are bullish and want to maintain NAV/AUM.

Consumer stocks: HUL, Colgate, Dabur, Nestle, Marico

Pharma stocks: >30 PE

MNCs: Blue Dart>110, Kenamental>90, GSK>60, Bosch >60x

Scarce/ Unique ideas: Just Dial > 80, Info Edge > 80, Jubililant Foodwork>70, Page > 70, Eicher > 60

The P/E (trailing twelve months) of Colgate has gone up from 34x in April 2014 to currently 48x. Similarly, Nestle from 42x to 53x, HUL from 33x to 44x, Dabur from 36x to 43x, Marico from 28x to 38x, etc. This is despite sales growth being slowest in the last many quarters for some of these companies (in some cases, up to eight quarters!). Similarly the P/E of some pharma companies have gone from mid-20x in April 2014 to mid-30x currently. The two other sectors which are captured by these institutions (partly overlapping with the two mentioned above) are MNCs and scarce/unique ideas. So, any MNC with a 75% parent holding is supposed to be a delisting candidate that justifies a ‘mu-maangi kimat’ for the tenderer (Blue Dart > 115x, 3M 90x, Kennametal 90x, Glaxo Pharma 60x, Bosch 60x). Scarce concepts in the listed space also command mind-boggling valuations (Just Dial 80x, Info Edge 80x, Jubilant Foodworks 75x, Page Industries 70x, Eicher Motors 60x etc.).

8 Fascinating Reads

Indonesians surveyed by Galpaya told her that they didn't use the Internet. But in focus groups, they would talk enthusiastically about how much time they spent on Facebook. Galpaya, a researcher (and now CEO) with LIRNEasia, a think tank, called Rohan Samarajiva, her boss at the time, to tell him what she had discovered. "It seemed that in their minds, the Internet did not exist; only Facebook," he concluded.

The problem

Here's a great summary of healthcare costs in America by Steven Brill:

Here's a great summary of healthcare costs in America by Steven Brill:

Priorities

Most big drug companies spend more on advertising than they do on research and development:

Most big drug companies spend more on advertising than they do on research and development:

Odds of success

Ben Carlson writes about one way to beat the market: concentrated portfolios:

Ben Carlson writes about one way to beat the market: concentrated portfolios:

Portfolio manager and author Robert Hagstrom performed a study that looked at 12,000 randomly generated portfolios from a universe of 1,200 stocks. He broke the portfolio up by the number of holdings so they looked as follows:

- 3,000 portfolios containing 250 stocks.

- 3,000 portfolios containing 100 stocks.

- 3,000 portfolios containing 50 stocks.

- 3,000 portfolios containing 15 stocks.

... Now take a look at the outperformance rates by portfolio size:

- Out of 3,000 250-stock portfolios, 63 beat the market (2% of portfolios).

- Out of 3,000 100-stock portfolios, 337 beat the market (11% of portfolios).

- Out of 3,000 50-stock portfolios, 549 beat the market (18% of portfolios).

- Out of 3,000 15-stock portfolios, 808 beat the market (27% of portfolios).

Personal life

More companies are moving from casual Fridays to no-work Fridays:

More companies are moving from casual Fridays to no-work Fridays:

That's exactly how founder and chief executive Ryan Carson, 37, has been working since 2005. These days, on Fridays, he gets his two young sons off to school and spends the day hanging out with his wife, Gill. "It's like dating again. We go to coffee shops. We read books together. I really feel like I'm involved in my kids' lives and my wife's life," Carson said. "This schedule has been absolutely life-changing for me. I can't imagine anything more valuable."

Just the facts

Josh Brown writes a great list of facts in America. Here are a few:

Josh Brown writes a great list of facts in America. Here are a few:

The US economy has now added more than a million net new jobs over the last three months. This was the best 90 days' worth of hiring since 1997.More jobs were created in 2014 than during any year since 1999.759,000 people just joined the labor force and there was no post-holiday seasonal decline – it may be that temporary workers are sticking.Average hourly wages rose .5% in January.The cost of living has only risen .8% over the last year while wage growth has outstripped it, rising by 2.2%.21 of 50 states put through minimum wage hikes, including populous ones like NY, FL and NJ.

Doing it right

Ronald Read left a surprise for those who knew him:

Ronald Read left a surprise for those who knew him:

His khaki denim jacket was held together with a safety pin and his flannel shirt was so old, someone once paid for his breakfast at Friendly's."The man ahead of him had paid for him," Rowell said, "Based on what he looked like and how he dressed."Perhaps that's why the man known for his extreme frugality and scruffy appearance decided in the years before his death that he'd do a little giving of his own."The estate of Robert Read made its first distributions to Brattleboro Memorial Hospital and the Brooks Library in the amounts of $4.8 million and $1.2 million," Read's attorney said in a press release.

Wisdom

Here's a great take on loss aversion from Andre Agassi, tweeted by Ben Carlson:

Here's a great take on loss aversion from Andre Agassi, tweeted by Ben Carlson:

Have a good weekend.

source: Now, an MF route to e-commerce

- Pramerica has approached Sebi to launch a scheme focused on the hot sector

- e-commerce boom: Valuation of direct plays are expensive. It is better to play e-commerce boom through Telecom, IT and logistic sector.

- Pramerica’s closed-end scheme, benchmarked to the CNX 500 and rated ‘high risk’, will allow small investors a piece of this action for as little as Rs 5,000, the minimum investment. “The objective is long-term capital appreciation by investing in equity & equity-related securities, including derivatives of a diversified set of companies benefiting from rise of e-commerce in India,” the fund house said in the scheme information document filed last week.

Average Industry RoIC (1992-2006)

Source:

https://janav.files.wordpress.com/2014/10/annualreport-industryroic.jpg

https://janav.files.wordpress.com/2014/10/annualreport-industryroic.jpg

https://janav.files.wordpress.com/2014/10/annualreport-industryroic.jpg

https://janav.files.wordpress.com/2014/10/annualreport-industryroic.jpgBusiness Models chart

18 business models chart:

https://pbs.twimg.com/media/B8EC0yWIcAAMlez.png:large

https://pbs.twimg.com/media/B8EC0yWIcAAMlez.png:large

Munger’s Psychology Mindmapped

source: https://janav.wordpress.com/2014/11/03/mungers-psychology-mindmapped/

Incentives

Psychological Denial

Incentive Caused Bias

Consistency and Commitment

Pavlovian Association

Reciprocation

Social Proof

Efficient Market Theory

Contrast Effects

Authority

Deprival Super-reaction Syndrome

Envy and Jealousy

Mis-gambling Compulsion

Liking

Non-Mathematical Nature of Human Brain

Why?

Other Biases

Lollapalooza Effects

[source: http://www.fool.com/investing/general/2015/02/13/the-extraordinary-story-of-americas-most-successfu.aspx]

It comes down to two factors, both of which are paradoxical and relevant to all investors in all industries.

1. Fear, disgust, hatred, and outrage toward a business is good for shareholders.

A lot of investors (understandably) want nothing to do with tobacco companies. Some pension funds are barred from owning them. And then there's the constant threat of litigation, which has hung over the industry for decades.It adds up to millions of otherwise enterprising investors who won't touch tobacco stocks.

A lot of investors (understandably) want nothing to do with tobacco companies. Some pension funds are barred from owning them. And then there's the constant threat of litigation, which has hung over the industry for decades.It adds up to millions of otherwise enterprising investors who won't touch tobacco stocks.

Low investor demand keeps tobacco-stock valuations low. Low valuations lead to high dividend yields. And high dividend yields, compounded over decades, add up to massive returns.

The more hated an investment is, the higher future returns are likely to be. The same is true vice versa. This is one of the most difficult investing concepts to come to terms with, but probably the most powerful.

2. Tobacco companies barely innovate. That keeps them sustainable.

Innovation is exciting because it promises something new. New products. New markets. A new future.

Innovation is exciting because it promises something new. New products. New markets. A new future.

But it's expensive. And even if you're great at it -- like Apple (NASDAQ: AAPL ) is -- you'll probably stumble one day.

The products Apple made just five years ago are utterly irrelevant today. The company has to reinvest itself every few years, continuously coming up with breakthrough products that blow us away. What are the odds it'll keep innovating consistently at the rate it has for another 20, 30, 50 years? Pretty low, I'd say. Even the best players strike out from time to time, and ruthlessly competitive markets show them no mercy. It's rare that a leader sticks around for more than a decade in industries that undergo constant change.

Companies that make the same product today they did 50 years ago are different. They don't innovate, but they don't have to. It's a boring business, but it can be beautiful for shareholders because it keeps the companies chugging along for decades, if not centuries.

The ridiculously large gains from compound interest occur at long holding periods. They key to building wealthy isn't necessarily high returns, but mediocre returns sustained for the longest period of time. You typically find that in boring companies that don't innovate, and sell the same products today that they did 50 years ago, and will likely be selling 50 years from now. Food, soap, toothpaste and, yes, cigarettes are good examples.

@_kirand Elementary common sense shouldn't be sold as magic potion. Remember EVA? @amitdipsite @adeepakindia pic.twitter.com/fQTiAoofZk

— Sanjay Bakshi (@Sanjay__Bakshi) February 13, 2015

Pat Dorsey’s Moats Mindmapped

Pat Dorsey’s Moats Mindmapped

Source: https://janav.wordpress.com/2015/02/12/pat-dorseys-moats-mindmapped/

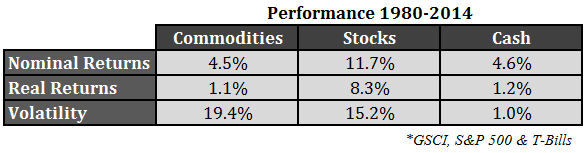

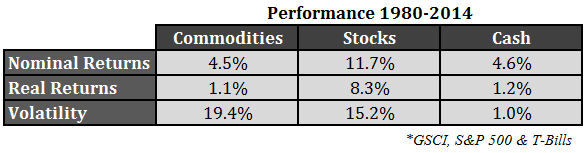

Commodities have returned less than cash since 1980 with more volatility than stocks

Source: http://awealthofcommonsense.com/1970s/

Commodities have returned less than cash since 1980 with more volatility than stocks

Commodities have returned less than cash since 1980 with more volatility than stocks

Creativity and Innovation in digital age

"In digital age, innovation (creativity) happens at team level rather than at individual level." - Walter Isaacson

Rent vs Own

"If it flies, floats or fornicates, always rent it - it's cheaper in the long

run." - Felix Dennis

Warren Buffett on importance of behavior

“Good profits simply are not inconsistent with good behavior.”- Warren Buffett

Warren Buffett on predictability of earnings

"If a company’s future cannot be predicted, it cannot be valued."- Warren Buffett

My near and dear ones might be surprised to find a post by me on HOW to GET LUCKY. Being an atheist, for long I have the denied role of luck or gave it much less importance than I should have. I don’t remember what exactly changed my opinion. But I do remember that when I read Malcolm Gladwell excellent book Outliers: The story of success, somewhere around 2009, it had significant impact on me. That book made me to realize that the professional success which I was enjoying till then, was also due to the fact that I was working under an analyst who was ready to give me much more independence and opportunity than available to other colleagues in my office.

“How to get lucky” helped me to understand so many concepts about luck better. As usual, I came across this book in one of the presentation of Prof. Sanjay Bakshi. The underlying message of the book is not to deny the role of luck in whatever we do. There are many ideas in the book, I am sharing few ideas, which I liked most. Unless otherwise stated,words in italics refer to extracts from the book “How to Get Lucky”. I also read another book The Success Equation: Untangling Skill and Luck in Business, Sports, and Investing by Michael Mauboussin. With due respect to Michael Mauboussin, I found How to get lucky much more easy to understand. Michael’s book is highly technical with lots of statistics and data.

Worst-case analysis – be prepared for catastrophe

I know this situation can go wrong. Now I’ve got to ask how it can go wrong. What is the worst possible outcome? Or if there are two or more ‘worst’ outcomes, what are they? How can it go wrongest? And if the worst does happen, what will I do to save myself?

We should factor in worst case scenario without suffering from Availability Heuristic. But as observed by Cass R.Sunstein in this article “people badly under-react to worst case scenarios”. He identified three reasons for that 1) Unrealistic optimism 2) Whether related events come to mind 3) Motivated reasoning

[Tversky and Kahneman explained in 1973, we assess the frequency, probability, or likely causes of an event by the degree to which instances or occurrences of that event are readily “available” in memory. And, of course, if something is not available in our memory, we simply cannot assign a weight to it so we leave it out of our decision-making process, leading us to make bad judgment calls.]

Before making investment in any company, its important for anyone to make sure that even in the worst case scenario, one will not incur PERMANENT LOSS OF CAPITAL and expected return is positive. As explained here, for delisting situations, worst case scenario should be withdrawal of delisting and one SHOULD NOT ASSUME that one will be smart enough to exit before opening of reverse book building.

Importance of Risk –Reward ratio

That [not understanding risk-reward ratio] is a recipe for poor positioning in the world of luck. It is essential to study risk-reward ratios. When a given risk is small and a potential reward large, you might as well take the risk and so position yourself to become a winner.

There are two ways to be an almost sure loser in life. One is to take goofy risks; that is, risks that are out of proportion to the rewards being sought. And the other is to take no risks at all.

All decisions involve some uncertainty……

Lucky people, as a breed, are able to live with the knowledge that some decisions will turn out wrong. This is part of their general habit of accepting risk. “You take risks going in and you take risks getting out. If you were to insist on 100% certainty, you would not be able to make any move.

Dr. Ben Carson [Yes, he is a doctor and not an equity analyst] highlighted the same point in his excellent book Take risk

All my life I’ve observed two groups of people who have made serious life-impacting mistakes in their approaches to risk. First are those people who sadly are so afraid to take any risk that they never actually manage to do anything of true significance in their lives. Second are those individuals who take all the wrong risks and tragically end up hurting or destroying themselves or others in the process. Lives are ruined either way, and both groups fail to reach their potential. They never discover or enjoy the true purpose for which God placed them on earth.

Related to risk-reward ratio and worst case analysis, I am reminded of the risk matrix suggested by Dr Ben Carson in his wonderful book Take risk.

“Whenever I face a hard decision or a risky situation in life (personally or professionally), all my thinking, all my analysis, all my planning can be boiled down to four simple questions:

1) What is the best thing that can happen if I do this2) What is the worst thing that can happen if I do this?3) What is the best thing that can happen if I don’t do this?4) What is the worst thing that can happen if I don’t this?One of the good example of risk-reward ratio was Aeonian Investments, in which losses was capped but upside uncertain.

Losing job

If you lose your job because of events that are not of your making, the unhappy episode may knock you down but needn’t knock you out. It needn’t, that is, as long as you see clearly that what has happened to you is only a case of bad luck. But if you automatically assume that every bad thing that happens to you is in some way your own fault, then bad luck will almost always become worst luck.

All this was a typically lucky reaction to adversity. The unlucky personality would seek just one way out of a hole – the obvious way: “I gotta find another job!” But Darrow’s reaction was more likely to bring success. His thinking went something like this: “It would be nice to find another job. I’ll try. But in case I don’t run into good luck along that route, I’d better look for luck in some other directions at the same time.”

Similar advice is given in the excellent book “The Gift of Job Loss”

Don’t push the ocean” is the favourite saying of a friend of mine. What she means is that when things are leaning a certain way, maybe it is for a reason. Instead of going against the tide, ride the wave. Maybe she was right. My brain started to work overtime. A mix of thoughts seemed to come to the surface, not very well aligned, uneven, nagging, and not making too much sense at first. The idea of taking some time off, of not fighting the potential job loss but embracing it with vigor, was slowly nesting in my head. Like a ray of sunlight parting the clouds, my gloom started to dissipate.

“Gift of Job Loss” is very close to my heart. I read this book immediately after I lost my job in Nov 2011 and it helped me to think rationally.

Process vs outcome

Never confuse luck with planning. If you do that, you all but guarantee that your luck, in the long run, will be bad.

Avoid learning false lessons from random events….

When outcomes are brought about by random events that are not under anybody’s control – events that we would define collectively as luck – then you must be very careful in determining what lessons may be drawn from them. The habit of deriving false lessons from life’s random happenings is a trait of the unlucky.

To read the same thing in the words of James Montier and Michael Mauboussin readhere

On Importance of networking

But he could know that his chances of getting a break improved in direct proportion to the number of people he knew. The lucky personality gets to know everybody in sight: the rich and the poor, the famous the humble, the sociable and even the friendless and the cranky. Whether you aspire to get into the movies or simply get a higher-paying or more exciting job, the rule is the same. Go where events flow fastest.

But it does not mean you have to know EVERYBODY …..

This doesn’t mean you have to be one of those Personality Kids who know everybody in town. We can’t all be the life of the party. Some of us are quieter than others. But we can all go around with a look and attitude that says we want to be friendly. We can stay active. The worst thing you can do is withdraw from the network of friendships and acquaintanceship at home and at work. If you aren’t in the network, nobody is ever going to steer anything your way.

But why is she in the right places at the right times?….

Because she has made the effort to be in many places at many times. Fate has given her a lucky break, but she has earned it. She has positioned herself for it.

Don’t speak unless you absolutely must or you may regret it later

The chronic loser buys some stock and blabs to his or her spouse, explaining all the reasons why this investment is so nifty. Bad luck obtrudes. The stock price plunges. This is the time when the speculator ought to apply the Fifth Technique, luck selection. The venture has soured, so it is time to discard bad luck before it becomes worse luck. It is time to sell out. But the loser, being a loser, has communicated too much. Now the spouse is jeering. “You sure know how to pick them! Wow, what an expert! This nifty investment has cost us 6,000 bucks so far. Boy I hope it doesn’t get any niftier!” The loser finds it impossible to say “I was wrong.” Instead, he is forced to take a stand: “This is just temporary, I tell you! Just wait. I’ll be proved right in the end!” And down the drain go the talky two. Since life is ruled by luck and you can never predict what actions you will need to take, it is best to say as little as possible about what you are doing and thinking. Then, when action is required, the only person you must argue with is yourself. That is often tough enough.

This doesn’t mean you must turn yourself into a stone statue…..

They are particularly careful when talking of subjects that have great personal importance to them. They reveal no more of their thinking than they have to. They don’t lock themselves into positions where there is no good reason to do so.

Mohnish Pabrai advises not to discuss one’s current holding widely for the same reason

If investors get in the habit of discussing their investments they may end up suffering from commitment bias. If they constantly talk about how great a company is, they may suffer from a bias that could impair their judgment.

Source: https://contrarianvalueedge.wordpress.com/2014/03/03/how-to-get-lucky/

Subscribe to:

Posts (Atom)