About company:

- Company belongs to Cello group. Incorporated in 1988. Listed on BSE in 1994.

- Company sells plastic moulded products under “CELLO” brand.

- In the year 1994 company setup on manufacturing unit of plastic moulded furniture at Daman in which company got grand success in the business. In the process of diversification in 2005 company has setup plants at Baddi, Himachal Pradesh for processing of bubbleguard extrusion sheets and also moulded furniture which a new innovation in India in the field of extrusion technology.

- Presently the company has manufacturing units at Daman, Baddi and Chennai also have Depots in Gujrat, Rajasthan, Andhra Pradesh, Haryana and Punjab and have strong consumer base through out the country.

- Website: http://cellowimplast.com/

Positives:

- Company has shown good growth in Sales, Net Profit. Also Net profit margins are improved.

- No debt.

- All plants are operational and contributing to top-line and bottom-line.no major capex plans.

- Promoters consistently increasing stake in company.

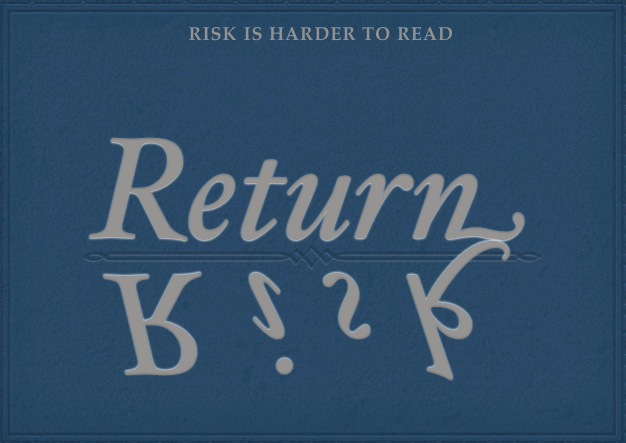

Negatives:

- Company does not enjoy competitive advantage. No pricing power.

- Increasing crude prices can impact profit margin.

Conclusion: Company is trading at PE of 6 at cmp of 190. Considering company has shown good grown in revenue and net profit and continue to show good performance going forward. I believe based on strong fundamentals, it is good to buy shares of company at current price.